All Categories

Featured

State Farm agents sell every little thing from homeowners to auto, life, and other popular insurance products. State Ranch offers global, survivorship, and joint global life insurance plans - back end load universal life.

State Farm life insurance policy is usually conventional, supplying stable options for the average American family. If you're looking for the wealth-building opportunities of universal life, State Farm does not have affordable alternatives. Review our State Farm Life Insurance policy review. Nationwide Life Insurance Policy offers all types of global life insurance policy: global, variable global, indexed global, and global survivorship policies.

It does not have a solid existence in other financial products (like universal plans that open the door for wealth-building). Still, Nationwide life insurance policy strategies are extremely available to American families. The application process can likewise be a lot more workable. It aids interested celebrations get their foot in the door with a reliable life insurance policy plan without the far more challenging conversations concerning financial investments, financial indices, etc.

Also if the worst takes place and you can't obtain a bigger plan, having the security of a Nationwide life insurance policy might change a buyer's end-of-life experience. Insurance coverage firms utilize medical examinations to gauge your danger class when applying for life insurance policy.

Purchasers have the choice to change rates monthly based on life conditions. Obviously, MassMutual offers exciting and potentially fast-growing possibilities. These strategies often tend to perform ideal in the long run when early deposits are greater. A MassMutual life insurance policy representative or economic advisor can assist purchasers make strategies with space for adjustments to meet temporary and lasting financial objectives.

Best Guaranteed Universal Life Insurance Companies

Read our MassMutual life insurance policy testimonial. USAA Life Insurance Policy is understood for supplying budget friendly and extensive financial products to army participants. Some purchasers might be amazed that it offers its life insurance policy plans to the public. Still, military members take pleasure in special advantages. As an example, your USAA plan features a Life Occasion Alternative motorcyclist.

If your plan does not have a no-lapse guarantee, you might also lose protection if your cash money worth dips listed below a particular limit. It might not be a fantastic alternative for individuals who simply desire a fatality advantage.

There's a handful of metrics through which you can evaluate an insurer. The J.D. Power client complete satisfaction score is a good alternative if you desire an idea of exactly how clients like their insurance coverage policy. AM Finest's monetary stamina ranking is another crucial metric to think about when choosing an universal life insurance policy business.

This is especially crucial, as your money worth grows based on the financial investment choices that an insurer provides. You should see what financial investment choices your insurance policy carrier deals and compare it versus the goals you have for your policy. The very best method to find life insurance policy is to collect quotes from as lots of life insurance policy firms as you can to recognize what you'll pay with each plan.

Latest Posts

Maximum Funded Life Insurance

Universal Life Comparison

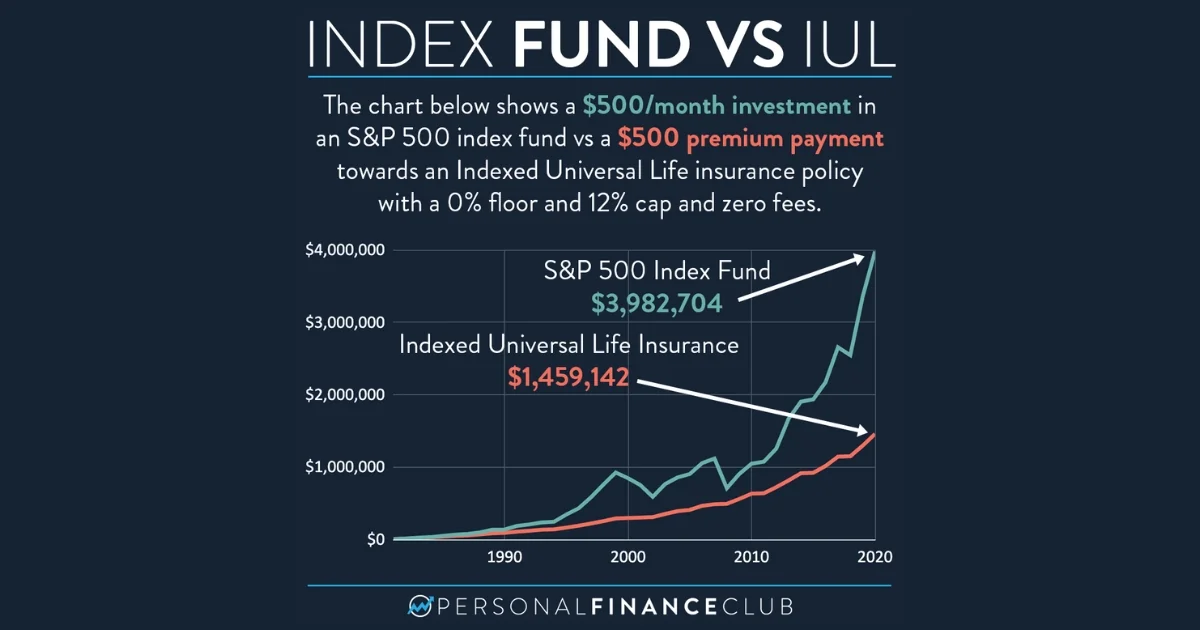

Why Universal Life Insurance Is Bad